hotel tax calculator illinois

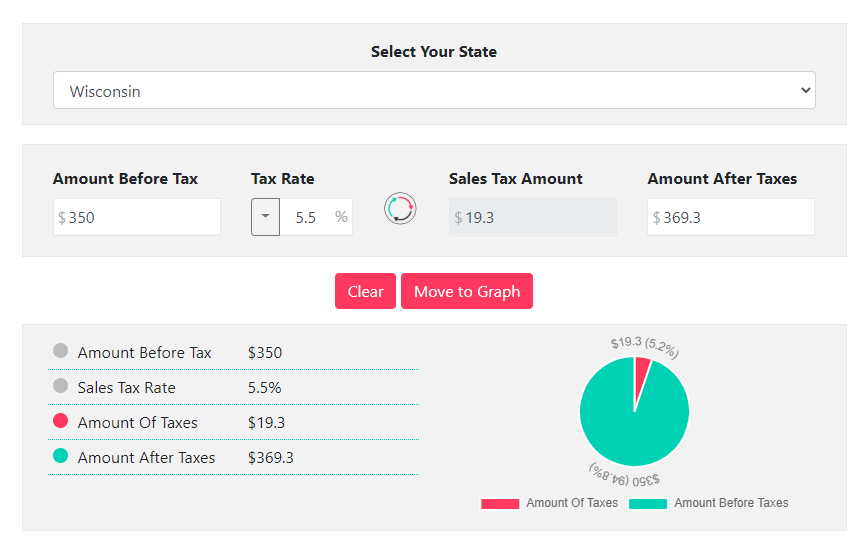

If you have any questions please contact the Department during business hours Monday through Friday from 830 am. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

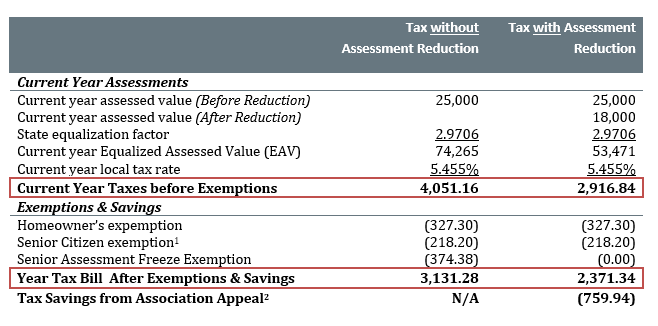

Should Unit Owners With Senior Freezes Still Appeal Their Property Taxes Elliott Law

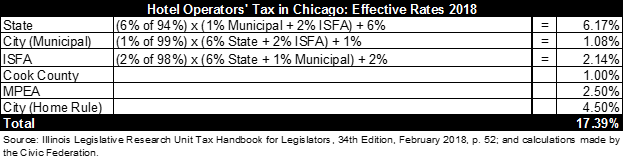

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation 2 of 98 tax on gross receipts in.

. Grocery Tax Suspension Required StatementSign - Effective July 1. The Hotel Tax does not apply to. Illinois applies per-gallon alcohol excise taxes based on the alcohol content of the beverage being sold.

The City projected revenue. At 312 603-6870 and press option 7. 15 Tax Calculators 15 Tax Calculators.

The following local taxes which the department collects may be imposed. Download a HotelMotel tax return form. DATEucator - Your 2022 Tax Refund Date.

4 Specific sales tax levied on accommodations. Except as noted on their respective pages the preprinted rate on the return will include any locally imposed taxes. 2021 Tax Year Return Calculator in 2022.

The department is providing a printable image of the required sign. Illinois Sports Facilities Hotel Tax. Depending on local municipalities the total tax rate can be as high as 11.

Also not city or county levies a local. Municipal Hotel Tax Chicago. Exemptions Deductions and Credits.

But it is worse in Illinois where drivers pay the nations second-highest gas taxes. Base rate of 45 of the gross rental or leasing charge. The Illinois Tax Estimator Will Let You Calculate Your State Taxes For the Tax Year.

The City projected revenue from the hotel accommodations tax in FY2019 would be 1263 million including the additional tax for home shares. It costs 134 to. Metropolitan Pier and Exposition Authority Hotel Tax.

If filing a tax period prior to April 2011 call 217 785. Motor Fuel Retailer Sign - Effective July 1 2022 through December 31 2022 Public Act 102-0700 requires a notice to be posted in a prominently visible place on each retail dispensing device that is used to dispense motor fuel in the State of Illinois. Before Tax Price Sales Tax Rate.

DEPENDucator - Dependent On Your Tax Return. 3 State levied lodging tax varies. Other local-level tax rates in the state of Illinois include home rule non-home rule water commission mass transit park district business district county public safety public facilities or transportation and county school facility tax.

The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available. All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms. The effective composite hotel tax rate in Chicago including hotel taxes imposed by other governments and agencies is currently 174 and the composite rate for home share rentals is 234.

Illinois Income Tax Calculator 2021. For vacation rentals and shared housing units a 4 surcharge in addition to the 45 base rate for a total City tax rate of 85 of the gross rental or leasing charge. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The Illinois IL state sales tax rate is currently 625. You may also send your questions to the Department via revenuecompliancecookcountyilgov. The Town of Normal collects a 6 tax on hotel and motel room rental.

Before-tax price sale tax rate and final or after-tax price. Of this tax a portion is distributed to the Bloomington-Normal Area Convention and Visitors Bureau while the remaining amount is used to support the Uptown Renewal Program. State has no general sales tax.

Hotel tax calculator illinois. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more than 160 rooms. Use our gas price calculator below to see.

The Federal or IRS Taxes Are Listed. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Pennsylvania Sales Tax Small Business Guide Truic

The Johnson County Kansas Local Sales Tax Rate Is A Minimum Of 7 975

Sales Taxes In The United States Wikiwand

Property Tax City Of Decatur Il

Illinois Sales Use Tax Guide Avalara

Hotel Operators Occupation Tax Excise Utilities Taxes

New York State Enacts Tax Increases In Budget Grant Thornton

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

New Hampshire Income Tax Calculator Smartasset

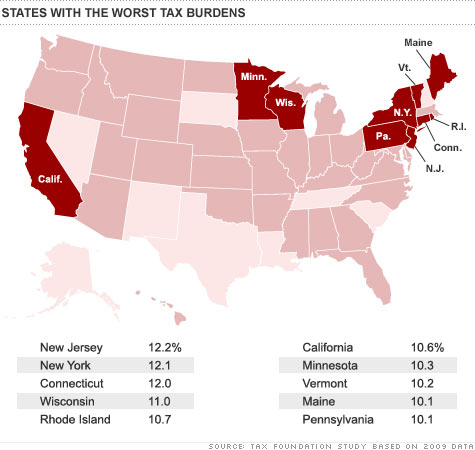

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

Sales Taxes In The United States Wikiwand

Illinois Sales Tax Guide And Calculator 2022 Taxjar

Calculating Sales Tax It Takes More Than Just Numbers

Idr Property Tax Tax Rate Lookup

Sales Taxes In The United States Wikiwand

The Independent Contractor Tax Rate Breaking It Down Benzinga